Introduction

In today’s fast-paced business world, managing payments efficiently is crucial for small businesses, freelancers, and entrepreneurs. Enter Melio, a leading business payment platform designed to simplify how businesses pay vendors, contractors, and suppliers. Whether you’re looking to streamline your accounts payable process or avoid the hassle of writing paper checks, Melio offers a modern solution tailored to your needs.

But with so many payment platforms available, you might be wondering: Is Melio the right choice for my business? In this comprehensive guide, we’ll dive into everything you need to know about Melio, from its standout features and pricing structure to real user reviews and how it stacks up against competitors. By the end of this post, you’ll have a clear understanding of whether Melio is the perfect fit for your payment management needs.

Overview of Melio

Melio is a modern business payment platform designed to simplify how small businesses, freelancers, and entrepreneurs manage their bills and payments. With its user-friendly interface and robust features, Melio has become a popular choice for businesses looking to streamline their financial operations.

At its core, Melio allows users to pay vendors and suppliers using a variety of methods, including ACH transfers, credit cards, and even paper checks. One of its standout features is the ability to schedule payments in advance, helping businesses stay on top of their cash flow and avoid late fees.

Melio is particularly appealing to small businesses because it offers free ACH transfers, making it a cost-effective solution for managing payments. For those who prefer to pay by credit card, Melio charges a small fee, but this can be a valuable option for businesses looking to earn rewards or manage cash flow more effectively.

Another key advantage of Melio is its seamless integration with popular accounting software like QuickBooks and Xero. This integration ensures that all payment data is automatically synced, reducing manual data entry and minimizing errors.

Melio also prioritizes security and compliance, using advanced encryption and adhering to industry standards like PCI DSS. This ensures that your business and vendor information are protected at all times.

In summary, Melio is a versatile and affordable payment platform that caters to the needs of small businesses. Its focus on simplicity, cost-effectiveness, and integration makes it a strong contender in the world of business payment solutions.

Key Features Comparison: How Melio Stacks Up Against Competitors

When choosing a business payment platform, understanding the key features is crucial. Melio stands out for its simplicity and cost-effectiveness, but how does it compare to competitors like Bill.com, PayPal, and QuickBooks Payments? Let’s break it down.

1. Payment Methods

Melio supports ACH transfers, credit card payments, and even check payments (both digital and physical). ACH transfers are free, making it a budget-friendly option for small businesses. However, credit card payments come with a 2.9% fee.

Comparison:

- Bill.com: Offers ACH and check payments but charges fees for both.

- PayPal: Supports ACH, credit cards, and PayPal balances, but fees can add up quickly.

- QuickBooks Payments: Similar to Melio but often requires a QuickBooks subscription.

Where to Add an Image: A comparison table or infographic showing payment methods and fees across platforms.

2. International Payments

Melio is primarily designed for U.S.-based businesses and does not support international payments. This is a limitation for businesses with global vendors or clients.

Comparison:

- PayPal: Excels in international payments with support for multiple currencies.

- Wise (formerly TransferWise): Offers low-cost international transfers, making it a better choice for global businesses.

Where to Add an Image: A world map graphic highlighting platforms that support international payments.

3. Integration with Accounting Software

Melio integrates seamlessly with QuickBooks and Xero, making it easy to sync payments and invoices. This is a huge time-saver for businesses already using these tools.

Comparison:

- Bill.com: Offers robust integrations but can be more expensive.

- QuickBooks Payments: Naturally integrates with QuickBooks but lacks flexibility for non-QuickBooks users.

- PayPal: Limited accounting integrations compared to Melio.

Where to Add an Image: A screenshot of Melio’s integration dashboard with QuickBooks or Xero.

4. Mobile App Functionality

Melio’s mobile app is user-friendly and allows businesses to manage payments on the go. Features include payment scheduling, vendor management, and invoice tracking.

Comparison:

- PayPal: Offers a well-established mobile app but focuses more on personal than business use.

- Bill.com: Has a functional app but is less intuitive compared to Melio.

- QuickBooks Payments: Mobile app is tied to QuickBooks, which can be overwhelming for some users.

Where to Add an Image: A side-by-side screenshot of Melio’s mobile app interface versus competitors.

5. Automated Payment Scheduling

Melio allows users to schedule payments in advance, ensuring bills are paid on time without manual intervention. This is a standout feature for busy business owners.

Comparison:

- Bill.com: Also offers payment scheduling but at a higher cost.

- PayPal: Lacks advanced scheduling features.

- QuickBooks Payments: Requires a subscription for advanced automation.

Where to Add an Image: A visual flowchart showing how Melio’s payment scheduling works.

6. Vendor Management

Melio simplifies vendor management by allowing users to add and pay vendors directly through the platform. Vendors don’t need a Melio account to receive payments, which is a major plus.

Comparison:

- Bill.com: Offers similar vendor management features but with a steeper learning curve.

- PayPal: Requires vendors to have a PayPal account, which can be inconvenient.

- QuickBooks Payments: Vendor management is tied to QuickBooks, limiting flexibility.

Where to Add an Image: A screenshot of Melio’s vendor management dashboard.

Pricing and Fees: How Melio Stacks Up

When choosing a business payment platform, understanding the pricing and fees is crucial. Melio stands out for its transparent and competitive fee structure, making it an attractive option for small businesses and freelancers. Here’s a breakdown of Melio’s pricing and how it compares to competitors.

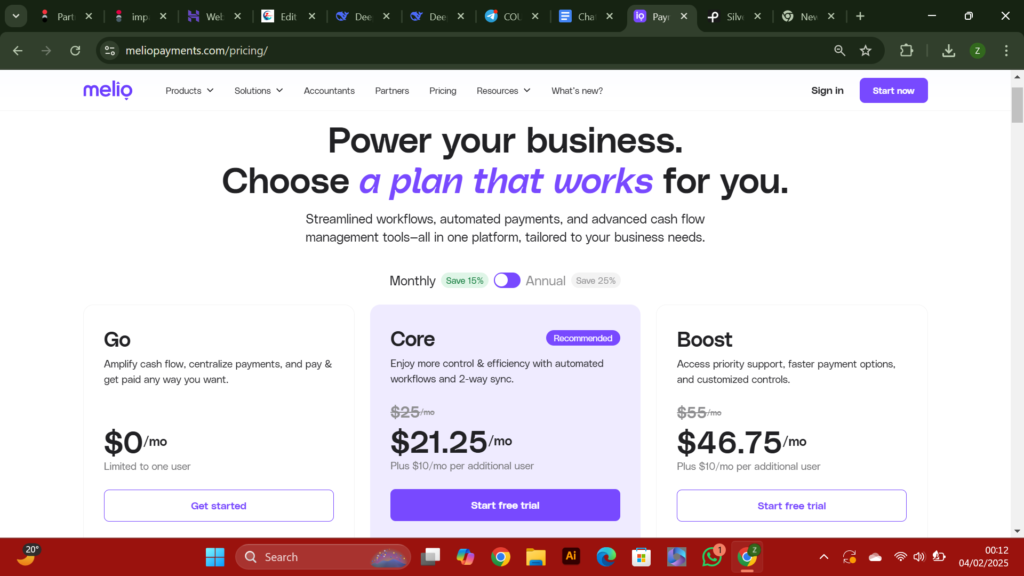

Melio’s Pricing Structure

Melio offers a straightforward pricing model designed to save businesses money:

- Free ACH Transfers: Melio allows users to send payments via ACH (bank transfers) at no cost. This is a significant advantage for businesses looking to avoid fees on routine transactions.

- Credit Card Payments: If you choose to pay vendors using a credit card, Melio charges a 2.9% fee per transaction. This is standard across most payment platforms.

- Check Payments: Melio offers free check payments, even if you’re mailing a physical check to a vendor who doesn’t accept digital payments.

- Express Delivery: For urgent payments, Melio charges a small fee for expedited processing. This ensures your vendors receive payments faster, which can be crucial for maintaining good relationships.

How Melio Compares to Competitors

When compared to competitors like Bill.com, PayPal, and QuickBooks Payments, Melio’s pricing is highly competitive:

- Bill.com: Charges a base fee of $39 per user per month, plus additional fees for ACH and check payments.

- PayPal: Charges 3.49% + $0.49 per transaction for domestic payments, which can add up quickly for small businesses.

- QuickBooks Payments: Charges 1% for ACH transfers (capped at $10) and 2.9% for credit card payments, making Melio’s free ACH transfers a clear winner.

Melio’s no-fee ACH transfers and free check payments make it a cost-effective solution for businesses that frequently pay vendors or contractors.

Where Melio Could Improve

While Melio’s pricing is attractive, there are a few areas where it could improve:

- International Payments: Melio currently does not support international payments, which could be a drawback for businesses with global vendors.

- Credit Card Fees: While the 2.9% fee is standard, some competitors offer lower rates for high-volume users.

- Ease of Use and User Experience

When it comes to managing business payments, ease of use and a seamless user experience are critical. Melio stands out as a user-friendly platform designed to simplify payment processes for small businesses, freelancers, and entrepreneurs. Here’s a closer look at how Melio delivers on usability and why it’s a top choice for businesses seeking a hassle-free payment solution.

Intuitive Interface

Melio’s interface is clean, straightforward, and easy to navigate. Whether you’re scheduling payments, approving invoices, or managing vendors, the platform’s design ensures that even users with limited technical expertise can quickly get the hang of it. The dashboard is well-organized, with clear menus and prompts that guide you through each step of the payment process.

Quick Onboarding

Setting up an account with Melio is a breeze. The onboarding process is simple and requires minimal information to get started. Once your account is verified, you can start adding vendors, uploading invoices, and scheduling payments within minutes. This is a significant advantage for busy business owners who don’t have time for complicated setups.

Mobile Accessibility

Melio offers a mobile app that mirrors the simplicity of its web platform. The app allows you to manage payments on the go, making it a convenient option for business owners who are always on the move. Features like invoice uploads, payment approvals, and vendor management are just a tap away, ensuring you never miss a payment deadline.

Automated Features

One of Melio’s standout features is its automation capabilities. You can set up recurring payments for regular bills, reducing the need for manual input. The platform also sends reminders for upcoming payments, helping you stay on top of your finances without constant oversight.

Customer Support

While Melio’s user experience is designed to be self-explanatory, the platform also offers robust customer support to assist users when needed. Although phone support is not available, Melio provides email and chat support, along with a comprehensive help center filled with guides and FAQs.

How Melio Compares to Competitors

Compared to competitors like Bill.com and QuickBooks Payments, Melio’s user experience is often praised for its simplicity. While other platforms may offer more advanced features, they can sometimes feel overwhelming for small business owners. Melio strikes the right balance between functionality and ease of use, making it an ideal choice for those who prioritize simplicity.

Security and Compliance: How Melio Keeps Your Business Safe

When choosing a business payment platform, security and compliance are critical factors to consider. Melio takes these aspects seriously, offering robust measures to protect your financial data and ensure compliance with industry standards. Here’s a breakdown of how Melio handles security and compliance, and how it compares to its competitors.

1. Data Encryption and Fraud Prevention

Melio uses bank-grade encryption to secure all transactions and sensitive data. This means your financial information is protected from unauthorized access during transmission and storage. Additionally, Melio employs advanced fraud detection tools to monitor transactions for suspicious activity, reducing the risk of fraudulent payments.

2. Compliance with Industry Standards

Melio is PCI DSS (Payment Card Industry Data Security Standard) compliant, which is a must for any platform handling credit card payments. This certification ensures that Melio adheres to strict security protocols for processing, storing, and transmitting cardholder data. Compliance with PCI DSS gives users peace of mind, knowing their payment information is handled securely.

3. Two-Factor Authentication (2FA)

To add an extra layer of security, Melio supports two-factor authentication (2FA). This feature requires users to verify their identity through a second method (e.g., a text message or authentication app) before accessing their account. 2FA significantly reduces the risk of unauthorized access, even if login credentials are compromised.

4. Secure Vendor Payments

Melio ensures that payments to vendors are secure, even if the vendor doesn’t use the platform. For example, if you pay a vendor via check, Melio handles the process securely without exposing your bank account details. This added layer of protection is especially valuable for businesses that work with multiple vendors.

5. How Melio Compares to Competitors

While many competitors like Bill.com and PayPal also prioritize security, Melio stands out for its user-friendly approach to secure payments. Unlike some platforms that require complex setups, Melio integrates security seamlessly into its interface, making it easy for small businesses to stay protected without technical expertise.

Integration and Compatibility: How Melio Fits Into Your Business Workflow

When choosing a business payment platform like Melio, one of the most critical factors to consider is how well it integrates with your existing tools and systems. Seamless integration can save time, reduce errors, and streamline your financial operations. Let’s dive into Melio’s integration capabilities and how they compare to other platforms.

1. Accounting Software Integration

Melio integrates seamlessly with popular accounting software like QuickBooks Online and Xero. This integration allows you to sync invoices, payments, and vendor details automatically, eliminating the need for manual data entry. For small businesses and freelancers, this feature is a game-changer, as it ensures accuracy and saves valuable time.

- QuickBooks Online: Melio syncs directly with QuickBooks, making it easy to manage payables and track expenses in one place.

- Xero: Similar to QuickBooks, Melio’s Xero integration ensures that your financial data is always up-to-date.

2. Payment Platform Compatibility

Melio supports a variety of payment methods, including ACH transfers, credit card payments, and checks. This flexibility ensures compatibility with vendors who may prefer different payment options. For example:

- If your vendor doesn’t accept credit cards, Melio can mail them a check on your behalf.

- If you prefer to pay via credit card to earn rewards, Melio allows you to do so, even if the vendor only accepts bank transfers.

3. Bank Account Integration

Melio connects directly to your business bank account, enabling you to make payments without manually transferring funds. This integration ensures that your cash flow is managed efficiently and reduces the risk of errors. Additionally, Melio’s platform is compatible with most major banks, making it accessible to a wide range of businesses.

4. API Access for Custom Integrations

For businesses with unique needs, Melio offers API access, allowing developers to create custom integrations with other tools and platforms. This feature is particularly useful for larger businesses or those with specialized workflows. While Melio’s out-of-the-box integrations are robust, the API adds an extra layer of flexibility.

5. Mobile App Compatibility

Melio’s mobile app is available for both iOS and Android devices, ensuring compatibility with most smartphones and tablets. The app allows you to manage payments, approve invoices, and track expenses on the go, making it a convenient option for busy business owners.

How Melio Stacks Up Against Competitors

While Melio offers strong integration capabilities, it’s important to compare it to competitors like Bill.com and PayPal:

- Bill.com: Offers deeper integrations with more accounting software but often at a higher cost.

- PayPal: Provides a wide range of integrations but lacks some of the specialized features Melio offers for small businesses.

Melio strikes a balance between ease of use and robust integration, making it an excellent choice for small businesses and freelancers.

Pros and Cons of Melio

When evaluating a business payment platform like Melio, it’s important to weigh its strengths and weaknesses to determine if it’s the right fit for your business. Below, we break down the key pros and cons of Melio to help you make an informed decision.

Pros of Melio

- User-Friendly Interface

Melio is known for its simple and intuitive design, making it easy for small business owners to navigate and manage payments without a steep learning curve. - No Fees for ACH Transfers

One of Melio’s standout features is its free ACH (Automated Clearing House) transfers. This can save businesses significant money, especially for those processing frequent payments. - Flexible Payment Options

Melio allows users to pay vendors via ACH, credit card, or even paper checks (mailed on your behalf). This flexibility is ideal for businesses working with vendors who prefer different payment methods. - Integration with Accounting Software

Melio seamlessly integrates with popular accounting tools like QuickBooks and Xero, streamlining bookkeeping and reducing manual data entry. - Automated Payment Scheduling

Businesses can schedule payments in advance, ensuring bills are paid on time and improving cash flow management. - Mobile App Accessibility

Melio’s mobile app allows users to manage payments on the go, making it convenient for busy entrepreneurs.

Cons of Melio

- Limited International Payment Options

Melio primarily supports domestic payments within the U.S. If your business frequently deals with international vendors, this could be a significant limitation. - Credit Card Processing Fees

While ACH transfers are free, Melio charges a 2.9% fee for credit card payments. This can add up for businesses that rely heavily on credit card transactions. - No Phone Support

Melio offers customer support via email and chat but does not provide phone support. This can be a drawback for businesses that prefer direct communication. - Limited Customization for Checks

While Melio can mail checks on your behalf, the customization options are limited. For example, you cannot add custom notes or logos to the checks. - Not Ideal for Large Enterprises

Melio is tailored for small businesses and freelancers. Larger enterprises with more complex payment needs may find the platform lacking in advanced features.

Conclusion

After thoroughly exploring Melio, it’s clear that this business payment platform offers a range of features designed to simplify financial management for small businesses and freelancers. From its user-friendly interface to cost-effective payment options like free ACH transfers, Melio stands out as a strong contender in the world of business payment solutions.

However, it’s important to consider your specific business needs. While Melio excels in ease of use and affordability, it may not be the best fit for businesses requiring extensive international payment capabilities or phone-based customer support. Comparing Melio to alternatives like Bill.com, PayPal, or QuickBooks Payments can help you determine which platform aligns best with your requirements.

If you’re a small business owner looking for a straightforward, affordable way to manage payments, Melio is definitely worth trying. Its seamless integration with accounting tools and focus on simplicity make it a valuable tool for streamlining your financial operations.